Your IP address indicates that you reside in a country to which we do not provide service. Please refer to Section III, part 2 of our Terms & Conditions for a complete list of restricted domiciles. For further clarification, please contact us at: [email protected].

Spot trading implies that investors are buying and selling at prevailing market prices, or "on the spot". If used prudently, spot trading can help investors maximize their profits. Through our CEX partnerships, Eterna investors can trade over 300 spot trading pairs.

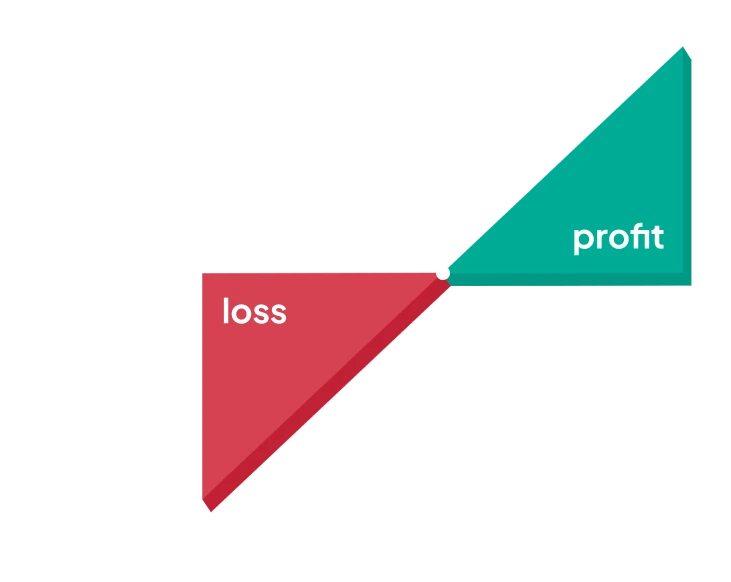

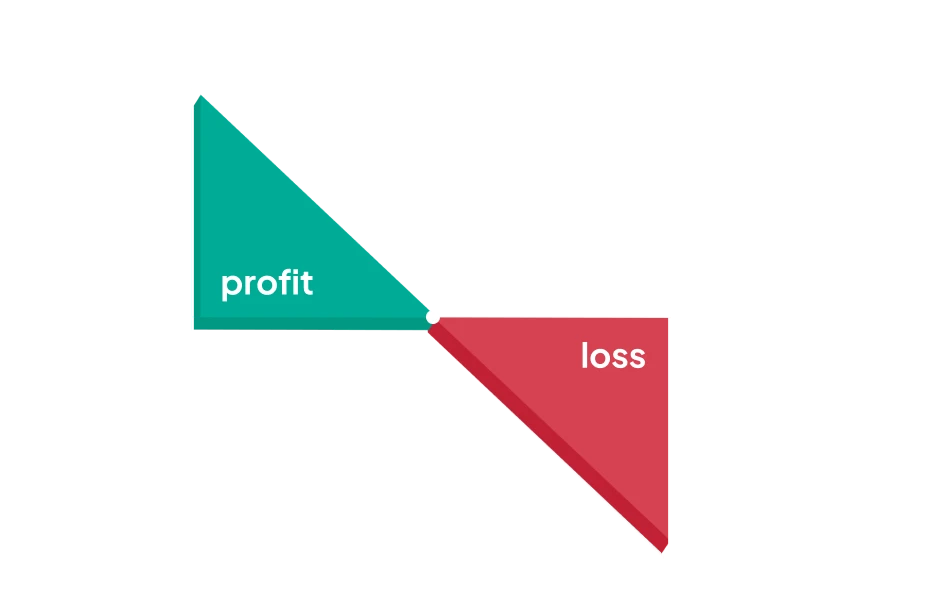

There are essentially two spot trading strategies; going long (buying) and going short (selling).

While Eterna offers investors many extra trading options, such as margin trading and copy trading, all trading can be ultimately reduced to long and short positions.

While spot trading refers to trading in one market and blockchain, Eterna’s universal swaps allows trading on different platforms across several distinct blockchains.

For instance, Eterna’s universal swap allows investors to exchange a cryptocurrency bought on Uniswap (the Ethereum blockchain) for a different asset trading on PCS (the Binance Smart Chain).

Eterna also offers perpetual futures margin trading, wherein investors can trade on margin, using leverage up to 125X on more than 200 perpetual trading pairs.

Because perpetual futures markets are highly leveraged, they are also the most profitable segment of the crypto market.

In general, the best way to manage risk is to distribute your funds over several assets.

Most investors in crypto lose money because they do not know how to select good assets,

and they don’t know how to HODL. Meme tokens can be highly valuable,

but they are also highly risky and are the most susceptible to scams and exploits.

High utility tokens can be the most valuable in the long run, but they often require several years for their value to mature.

A good strategy can be to distribute your funds over a wide variety of tokens, including established meme tokens (such as Doge or Shiba) and high utility tokens.

The more widely you distribute your funds, the lower your overall risk of loss.