Leverage refers to the act of using borrowed capital to trade in the market.

The ultimate goal for any trader is to make profits on their investments. The sentiments are the same be it crypto, forex, or stock trading. Investors and traders will always want to maximize their profits through speculation and opening positions that they believe will bring them more returns.

Higher the investments, the greater the risks, and the returns.

However, a trader might not always have enough liquid to invest in the asset they wish to. This might limit the amount of profit they realize on any trade. This is where leverage comes into play.

Leverage allows traders to substantially increase their buying or selling power by letting them trade in larger amounts. So, even if you happen to have only $100 in your wallet, you can end up opening positions 10x, 20x, and sometimes even 100x of that amount. This means even though you have just $100 with you, you could use this amount as collateral and open buying or selling positions of $1000, $2000, or even $10,000 respectively, thereby amplifying your potential profits.

However, if you are using leverage in a highly volatile market like the crypto market, you should be careful about the amount of leverage you take on, as even slight movements against your position, in a highly leveraged trade can lead to huge losses and higher chances of liquidation.

The idea of leverage is the same in all sorts of trading, be it crypto trading, forex, or margin trading.

In this article, we are going to take a look at each of these scenarios one at a time.

Leverage in crypto trading

Leverage in crypto trading allows you to buy or sell amounts higher than the capital you hold in your wallet. Depending on the crypto exchange, you can trade up to an average of 100 times your wallet balance. Eterna Exchange allows up to 125 times leverage to traders on its platform.

How does leverage work?

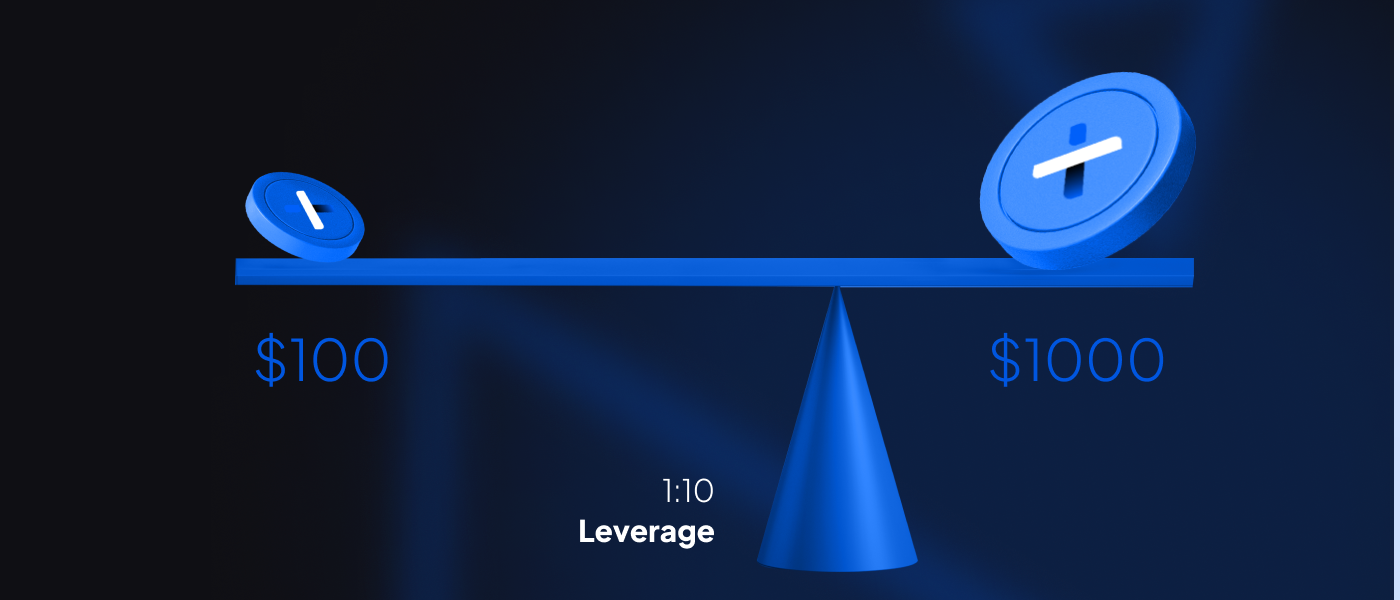

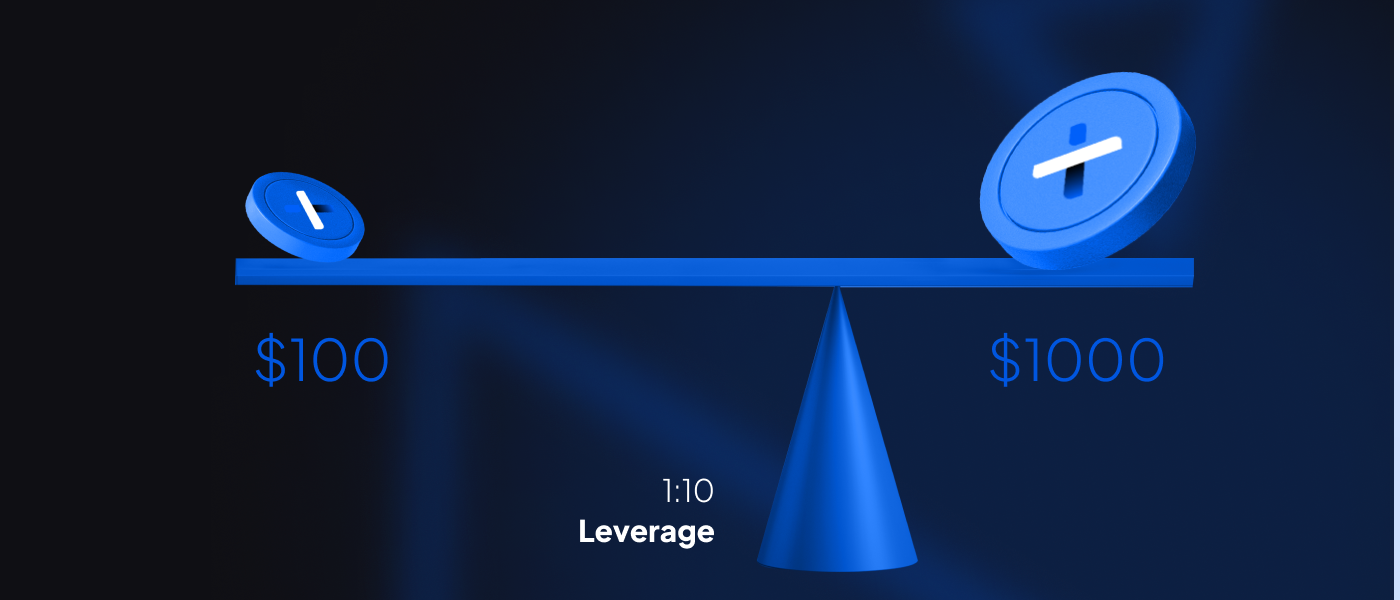

Leverage is usually described in form of ratios, such as 1:5, 1:10, and 1:100.

This means that for every $1 you own, you get to use it as collateral to access 5x, 10x, or 100x of the amount to trade on the exchange. So, if you had $100 in your wallet and would like to open a buy position for $1000 worth of bitcoin, you can do that with a 10x leverage.

You put the $100 down as collateral and in return, you get $1000 to open your buy position.

There are quite a few different types of leveraged trading options available on cryptos, like margin trading, futures contracts, and leveraged tokens.

Let’s take a look at how exactly leveraged trading works.

As shown in the example earlier, say you have $100 worth of capital in your wallet. You put that down as collateral to access 10x (1:10) leverage to be able to trade in $1000 worth of bitcoins. The amount you put down as collateral ($100) is referred to as the margin.

The higher the leverage you use for the same amount you want to trade in i.e. $1000, the lower will be margin amount.

Margin amount = 1/10 x $1000 = $100

In the case of 20x leverage the margin amount will go down to $50

Margin amount at 20x leverage = 1/20 x $1000 = $50

However, note that the higher the leverage and lower the margin amount, the higher the chances of liquidation in case the market starts moving against your position. Even a slight change in the market can push a highly leveraged trade into liquidation. Hence, when dealing in the crypto market, which is volatile in nature, it’s best to be prudent about how much leverage you are using in your trade.

You should always keep an eye out for liquidation communication from the broker, and be ready to pump in more capital into your wallet to avoid liquidation and maintain your margin threshold for your position.

What is liquidation in crypto?

Before we discuss how to use leverage in crypto further, let’s look at what is liquidation and how it works.

Since leverage is largely based on trading on borrowed capital, the broker/lender tries to protect their position, as well, if they see the market moving against the position they have leveraged.

For example, if you have a long position on bitcoin and you borrowed against $100 at a 20x leverage hoping the price of Bitcoin will go up further and you’ll get amplified returns on your $2000 investment, and end up seeing the price of Bitcoin falling and your trade hitting $1900. This means you have already clocked a $100 loss, which is the collateral you’d offered the broker in exchange for leverage. If you want to avoid liquidation, you will need to pump in more capital into the wallet to increase your collateral and thus your margin threshold.

Leveraged trading works for both long and short positions and unlike spot trading, leverage trading allows you to open short positions based on your collaterals and not on your holdings. So even if you do not have a particular crypto in your portfolio, you can still short it using leveraged trading.

Why use leverage in crypto trading?

The reason traders use leverage in trading is to maximize their profit potential. Simply stated, if you had only $100 in your wallet which you traded and received $5 profit, that’s all the profit you could realize from that transaction.

However, if you would use your $100 as collateral for a 20x leverage, you could easily multiply that $5 profit 20x and get a $100 profit instead.

The higher the leverage, the higher the profit potential of your trade.

How does leverage work in forex trading?

Leverage works in forex trading pretty much the same way it works in crypto and stock trading. In fact, leverage in forex trading is less risky given the small changes in currency movements. The most common leverage used in forex thus is 100:1. So, if you have $100 as collateral with a 100x leverage, you can trade in currency worth $10,000.

Let’s take a look at an example here.

Suppose you have $1000 (USD) as capital and you want to trade in Australian dollars (AUSD).

At the going market rate (US$1 = AUS$1.5) you will get $1500 for the $1000 worth of capital you have.

Now, you speculate that the price of AUSD will increase as the currency gets stronger against the USD. At the end of the day, as you had speculated, AUSD got stronger by 10 cents for every dollar, which means, now the US$1 = AUS$1.4. Therefore, now when you sell your AUS$1500 you will get US$1070, which means a profit of USD$70.

Now, if you had used the leverage of 100x for this trade, you could have easily multiplied your profit by 100x, which means, a US$7000 profit.

[Note: The fluctuation reflected here is just for the sake of an example. Such large movements in currency prices are not usual in the forex market.]

Margin trading vs. Leverage trading in crypto

While both forms of trading entail borrowing capital to invest further or increase your open position, there’s a distinct difference between margin trading and leverage trading.

In order to trade on margin, you need to have capital in your trading account present to use as collateral to borrow further from the broker or the exchange platform.

On the other hand, when it comes to leverage trading, you have an understanding of the crypto exchange whereby it extends a credit facility to help you magnify your position and amplify your profits.

Risk management and speculation in leverage trading

Most of the leverage trading is done on the basis of speculation. In order to reap the substantial benefits of the market, traders need to be well informed about market conditions and movements and predict whether the value of an asset is about to rise or fall. This also entails a lot of research and a thorough understanding of the asset’s movement with respect to the market.

Beginners however lack the resources and understanding to reap the kind of benefits seasoned traders do. They are often content with spot trading and the smaller profits, hoping to enter the bigger game sooner or later.

However, Eterna Exchange is trying to help new traders reap the benefits of leverage trading and perpetual futures contracts sans substantial knowledge of the market movements or trading experience. Its Copy Trading feature helps new traders to imitate the trading decisions of seasoned traders and use leverage to maximize their profits more than what they would have done in spot trading. Eterna offers a 125x leverage and it does not have any caps on it when it comes to beginners. That’s how powerful the Copy Trading feature is.

And this is just a sneak peek of how easy and seamless Eterna is making the crypto space for beginners and more dynamic for traders with market experience through its hybrid exchange platform.

Conclusion

Leverage is an extremely powerful concept in trading. It not only amplifies your profits but also allows you to invest in a larger array of asset classes and expand your open position further, thereby minimizing your portfolio risk while ensuring profits from your individual trades. Whether you are a novice in trading or a pro, leverage is something every trader should use and experience based on their individual risk appetite.

Of course, much like any other investment and trading practice, it is important that traders do their own research, study the market movements, and speculate with a hint of caution. For inexperienced traders, it is always advisable to start with lower leverage and keep an eye out to ensure they can avoid liquidation or put stop-loss orders to ensure they do not incur losses on their investment.

As a precaution, always stay updated on the market movements. Log in to Eterna to track buy and sell signals and use copy trading to increase your profit-making opportunities.