A crypto trader has numerous options of instruments they can invest in.

There is staking, margin trading, strategy trading, and of course, spot trading.

The end goal for any kind of trading or investment is to maximize profits. While spot trading is one of the most common forms of trading in crypto, there is yet another crypto asset that could help reap better returns.

We are talking about Perpetual Futures Contracts in crypto. One of the best crypto assets to help you manage both volatility and risk effectively, especially in the current market situations which are both dynamic and unpredictable.

Unlike its short-term counterpart, spot trading, perpetual futures needs a better understanding of the asset, market movements, and a clear strategy to reap sizeable benefits.

So if you are someone who is in it for bigger and more informed gains from your investments, do read on.

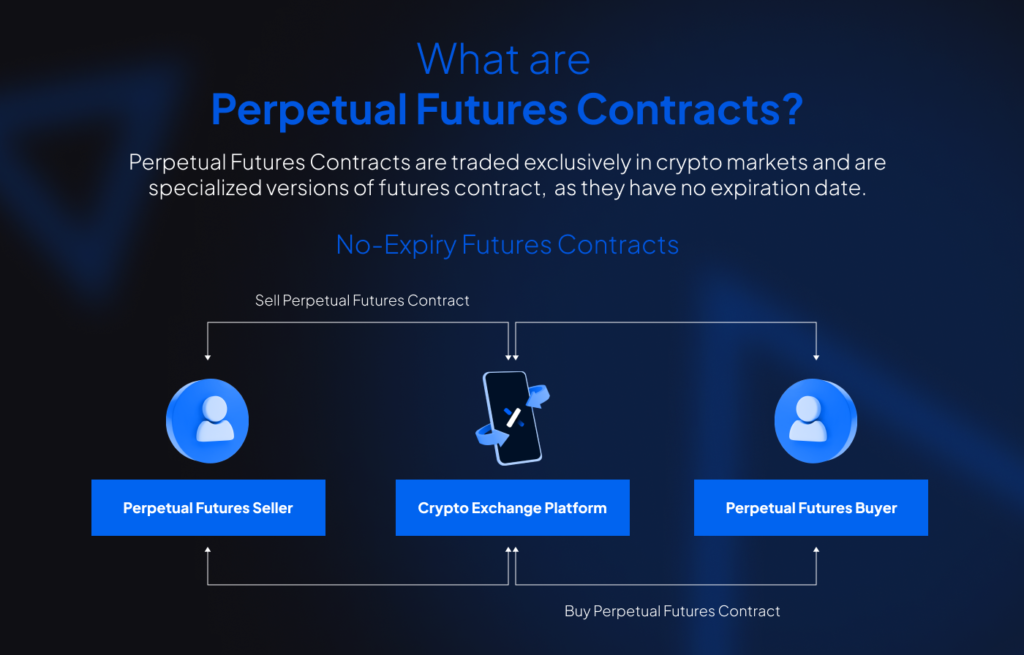

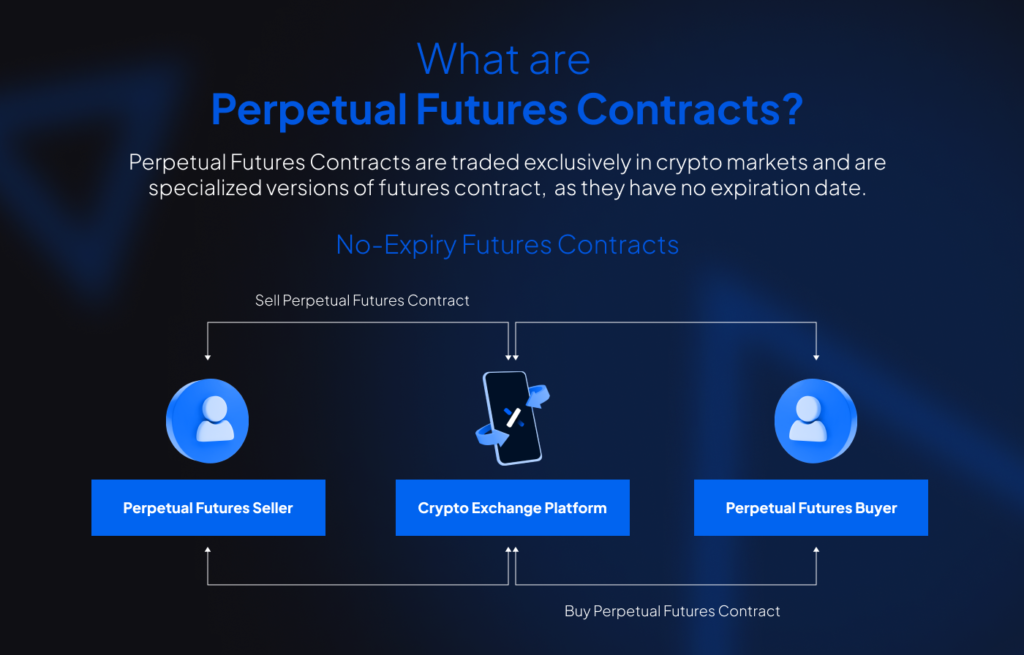

What are Perpetual Futures Contracts?

To understand this crypto asset, we need to understand what Futures are, first.

Futures are a part of the crypto derivative market. A derivative is a financial instrument whose value is derived from the current market price of the underlying asset. This underlying asset could be any asset, such as currencies, bonds, commodities, and stocks, among others.

Since the value is derived from the underlying asset, it gets the name derivative. With derivatives, you can manage risks and speculate. This is possible because of the uniqueness of the nature of futures contracts.

Futures allow two parties to enter into a contract to buy or sell a derivative sometime in the future, the terms of which are decided on the current day. The party to buy the derivative could specify a price they would pay for it on a future date, based on their speculations and understanding of risk at that moment. This agreement is sealed with a contract. Hence the term contract.

These derivatives are called perpetual given the absence of a set execution period. This is what marks the main difference between perpetual and regular futures: their maturity.

How do they work?

Perpetual futures contracts are often traded at a value that equals or is close to the spot market price on that day.

How does the perpetual futures contract stay close to the spot market pricing?

This is possible through financing. The difference between the spot price and the perpetual futures contracts determines which party will be paying the sum. When the funding rate is positive, traders with long positions pay the ones with shorts and vice versa.

Perpetual futures contracts in crypto could easily become as sought after for both trading and investment, as they are in the financial markets. The potentially high returns from this asset are making it more attractive to crypto traders and investors. The only thing you need to consider while investing in Perpetual Futures Contracts is that it requires considerable knowledge and both insight and foresight.

Conclusion

Perpetual futures contracts in crypto are a lucrative asset for crypto investors and traders because of the high returns they promise. However, the high returns do come along with high risk. The best approach to investing or trading in Perpetual futures contracts is to be cautious and consider risk management practices. This applies more so to traders who are using leverage to deal in perpetual futures, because if they do go into an unprofitable position, then they will be immediately liquidated.

If you would like to trade in Perpetual futures, you must have prior knowledge and experience in managing simpler instruments, such as margin and spot trading.

The good news is Eterna Hybrid Exchange is now offering a feature called Copy Trading, which allows you to copy the trading practices of the pros who have the significant market knowledge and insight to make more out of their perpetual futures investment. This will ensure you too, can reap the benefits of this fantastic crypto investment without having to spend a lot of time studying the market and gaining more hands-on knowledge.

Head over to eterna.exchange to find out how you can get started.

References: