Why hasn’t cryptocurrency taken over visa payments yet? It’s because while Visa processes 1700 Transactions Per Second (TPS), Ethereum and Bitcoin process 15 and 4.6 TPS respectively.

If you were waiting to pay for your supplies with crypto, you’d be waiting for a good amount of time.

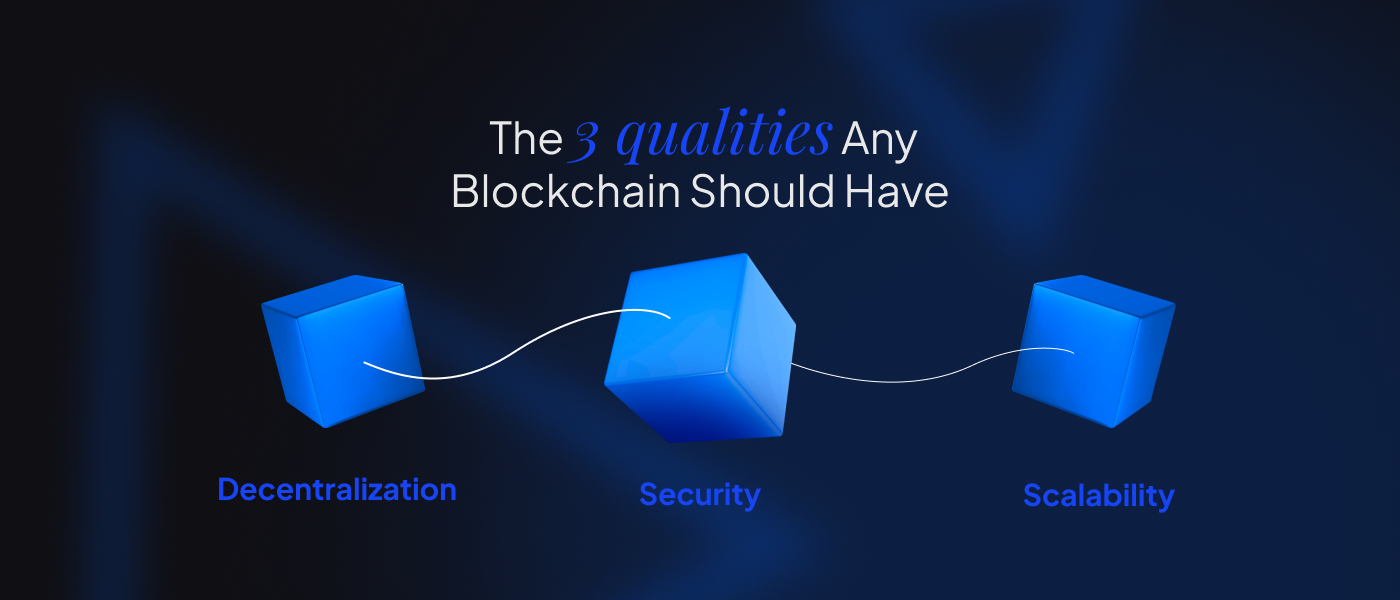

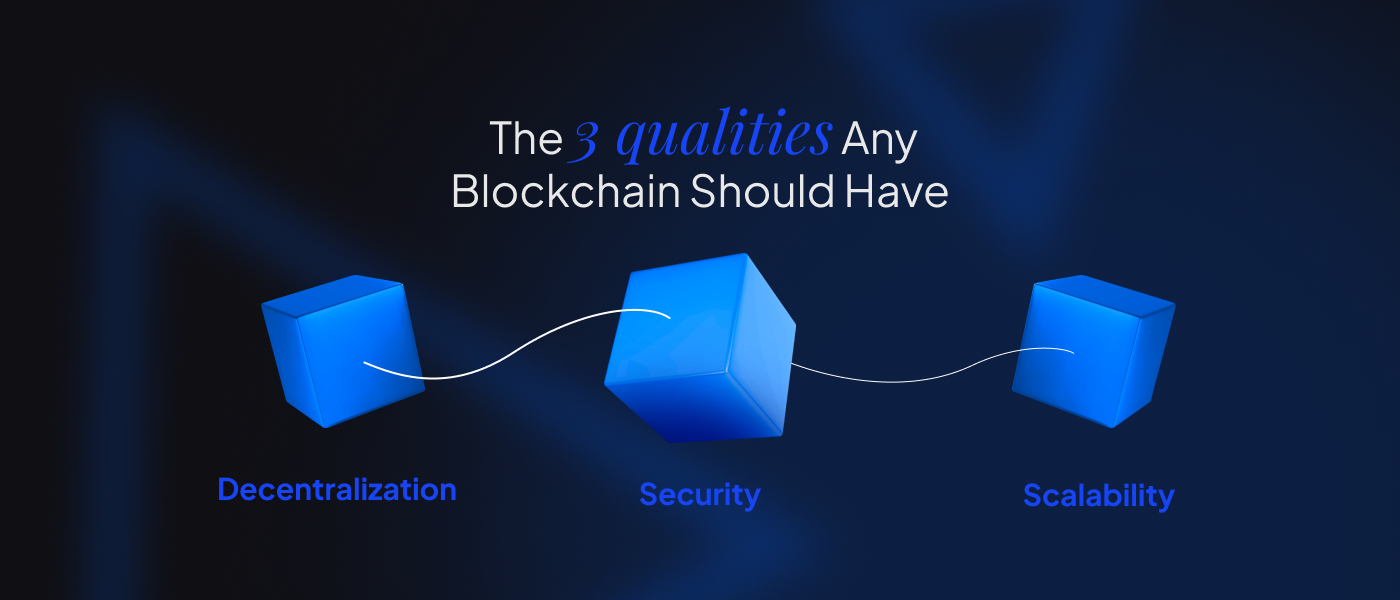

Despite being decentralized and way more secure than its fiat counterpart, scalability has always been an issue for Blockchains. Ethereum co-founder, Vitalik Buterin, named this problem the Blockchain Trilemma. The need for a blockchain to be:

- Decentralized

- Secure

- Scalable

It is said that finding a blockchain that fulfills all three requirements is a task. For example, Both Bitcoin and Ethereum promise decentralization and security as a part of their blockchain, however, scalability isn’t really their forte.

This is the reason why Ethereum recently moved its consensus mechanism from Proof of Work (PoW) to Proof of Stake (PoS) which helped it boost speed and efficiency in verifying transactions while also bringing down energy consumption by 99.95%.

But this is just the beginning. Blockchain founders across the world are trying to find out ways to add all three requirements to their blockchains and this is where Layer 1 comes in.

Understanding the architecture of blockchains will help you understand what exactly is Layer 1 and Layer 2, and how are they helping solve the Blockchain Trilemma, if at all.

What is Layer 1?

Layer 1 is the foundational network of a blockchain platform. It is the master dataset that acts as the source of truth for the public ledger.

Every time a deal occurs on a network, it goes through the consensus mechanism, which is crucial and distinct to each blockchain platform. The consensus mechanism then verifies and okays the deal. The layer 1 blockchain also has its own native cryptocurrency which is used to pay for transaction and gas fees.

While for major and popular blockchain networks like Bitcoin and Ethereum, decentralization and security weren’t really a problem, scalability soon became an issue when each transaction started taking lots of time and resources in the form of cost and energy. Proof of Work was no longer energy efficient nor cost-efficient. In order to compensate for this missing piece of the puzzle, developers came up with layer 2, designed to take care of whatever requirement layer 1 couldn’t take care of. Since scalability was an issue for most, Layer 2 in blockchains became the layer that would work in tandem with layer 1 but would solve the problem of scalability for it.

Examples of Layer 1 blockchains

Bitcoin

Bitcoin’s layer 1, its mainnet, is what supports the world’s most traded cryptocurrency with a market cap of USD 322.3 billion. Bitcoin works on a Proof of Work (PoW) consensus mechanism whereby miners compete with each other to solve complex cryptographic puzzles to gain a chance of verifying and adding the next block to Bitcoin’s blockchain and earning some native coins. While it is considered one of the most secure, decentralized platforms, scalability becomes a real issue with Bitcoin processing each transaction for approximately 10 minutes to an hour.

Ethereum

A close successor to Bitcoin, Ethereum, the world’s second-largest Layer 1 Blockchain brought the concept of smart contracts to the world of Web3. Its unique use case helped it evolve into something way more than a cryptocurrency and payment platform. Smart contracts are self-executing contracts that are fulfilled when all the pre-mentioned conditions are met. While Ethereum, too, used a PoW consensus mechanism in its initial days, it recently transitioned (Sept 15, 2022) to a Proof of Stake (PoS) consensus mechanism whereby miners need to stake a portion of their holding of the native coin to be eligible to be elected to verify the next block.

Cardano

Known for its high degree of decentralization and cheap gas fees, Cardano is the first Layer 1 blockchain to successfully implement PoS and outperform Ethereum’s transaction speed by validating over 250 TPS to the latter’s 15 per second.

Elrond

Built to outperform market leaders like Bitcoin and Ethereum, Elrond provides better scalability and reduced computational waste. This Layer 1 Blockchain adopted an adaptive state sharding mechanism that helps it boost scalability by employing three types of sharding:

- Network sharding – Manages how nodes are grouped into different shards

- Transaction sharding – Allots transactions to shards

- State sharding – Since shards have only a partial view of the network, cross-shard communication helps them coordinate during transactions.

Solana

Probably the fastest Layer 1 blockchain, Solana is capable of churning over 65,000 transactions per second. It’s known for its innovation of the Proof of History consensus mechanism which uses cryptographic timestamps to establish the order of events in transactions.

Each node in Solana is equipped with a clock that helps the network reach a consensus on the time and order of an event, thereby eliminating dependence on the other nodes. This helps it scale beyond its counterparts and deliver its admirable transaction speed.

Conclusion

While each Layer 1 blockchain has been working to alleviate the Blockchain Trilemma, scalability continues to be an issue for all of them. This is where Layer 2 comes into the picture. Layer 2 in the Blockchain architecture is built on top of Layer 1 and focuses on providing the missing element in layer 1, thereby solving the trilemma.

Blockchain networks have worked around various solutions to solve the Blockchain Trilemma with various approaches like changing the consensus mechanism (as in the case of Ethereum), increasing the block size to make it large enough to process more transactions (improving scalability), and sharding as discussed earlier.

In our next post, we are going to talk about these approaches in detail and explore the difference between Layer 1 and Layer 2 further.