The price of cryptocurrency depends on several market and non-market factors. Right from the technology backing the cryptocurrency to the market movements per demand and supply that also apply to fiat currency.

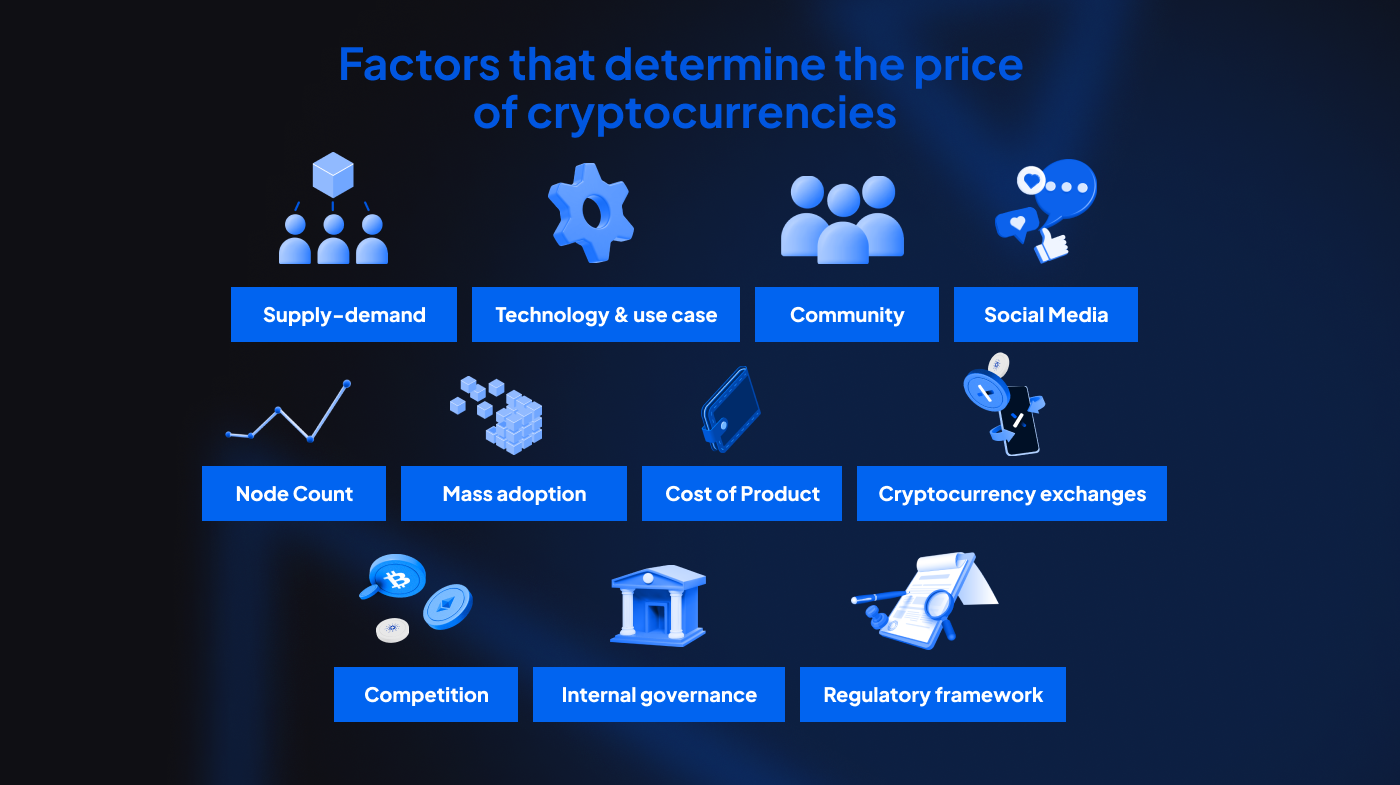

In this article, we will do a deep dive into some of the most crucial factors that determine the price of a cryptocurrency, namely:

- Supply-demand

- Technology & use case

- Community

- Social Media

- Node Count

- Mass adoption

- Cost of Product

- Cryptocurrency exchanges

- Competition

- Internal governance

- Regulatory framework

Let’s get started.

Supply-demand

The laws of supply and demand determine the value of a cryptocurrency. According to the law, the more something is available in the market, the lower its value, all other things being equal. This means if there is a high supply of a cryptocurrency in the market and not many people want to buy it (less demand), it will drive down the price of the cryptocurrency.

However, there is a slight twist to this situation. While many coins are mined and burned to maintain supply in the market, there are some cryptocurrencies like Ethereum which have an unlimited supply, and yet their value keeps increasing. To understand why this happens, we will have to take a look at some of the other price-determining factors.

Technology & use case

The use case and tech behind a project also determine a token’s price potential to a large extent. Many coins are backed by a project which is looking to solve a problem and deliver some utility to its users. To find out if the coin is indeed valuable, we should ask questions like if the project is really solving a real-world problem and if there’s promising technology backing it.

For example, Ethereum enables smart contracts built on its blockchain to operate sans fraud or downtime. It also provides another utility to users. Because it is programmable, Ethereum allows developers to create distributed applications.

Thus, despite being in continuous supply, Ethereum continues to witness an overall secular rise in value given its strong value proposition, use case, and the tech backing it.

There is yet another part of technology in cryptocurrency that is very important in determining the pricing of a token: its safety.

Let’s take a look at an example to understand this:

An Ethereum-based smart contract for a DAO had a bug in it. This vulnerability was then exploited by a hacker who gained access to $30 million worth of Ether. To fix this situation, the Ethereum community decided to alter the Ether blockchain. However, this was not a unanimous decision. Part of the Ethereum community thought that this change would affect the integrity of Ether. Consequently, Ethereum was split in two: Ethereum Classic (the original code), and Ethereum (the updated code). Everyone who held Ether then received coins of both kinds and they both could be traded in the market like any other coins. This kind of situation in which the community is divided on what’s to be done is called a fork. Forks can have a huge impact on the price of cryptocurrency.

Community

This brings us to yet another important factor of price determination in tokens, the community. The community backing a blockchain can make or break it. This refers to how much the people involved or supporting the blockchain believe in its purpose and are ready to back it no matter what. Bitcoin, one of the fastest-growing blockchains in crypto, has hardline believers who are ready to HODL (Hold On For Dear Life). The blockchain should not only focus on building a strong community but also give its users some utility through which they can use the coins they are holding. This improves the price of the coin significantly.

Social media

Community and social media go hand-in-hand. Social media platforms like Twitter and Reddit play a major role in influencing coin or token prices. Elon Musk’s tweets on DOGE coin drove its value up by 11,000%. Many crypto communities start growing with their roots in social media. This is the place where they talk about their project, share the latest updates, and acquire interested individuals and early adopters who are ready to give the DAO a chance. Hence, social media, public sentiment, and FOMO (Fear Of Missing Out) play big roles in determining the price of a cryptocurrency.

Node count

Node count refers to the measurement of the number of active wallets on the network which can be found on the homepage of the currency. Node count can help determine if a currency is priced fairly. We can do that by finding out the node count of the currency and its total market capitalization and comparing it to other cryptocurrencies. This count also helps ascertain the strength of a community. The more nodes, the stronger the community. The stronger the community, the higher its chances of overcoming crises and market volatility, thus driving up its demand and price.

Mass adoption

When the community backing the cryptocurrency starts growing and it becomes more popular, many people might want to own a part of it. This sudden surge in demand can drive the price of the token up, especially because most cryptocurrencies are limited in supply. Mass adoption is not a common factor yet in the cryptocurrency scene especially because the utility is still limited. If cryptocurrencies operated like fiat currencies and could be widely used to transact in real life, this would certainly drive up their price.

Cost of production

New tokens are created through a process called mining. This involves decentralized miners using a computer to verify the next block on the blockchain. The miners get cryptocurrency as a reward for their work along with any fees that the exchanging parties owe the miners.

Verifying blocks on the blockchain requires substantial computing power. Miners invest in costly equipment and electricity to mine. The more popular a cryptocurrency, the more competition among miners, and the more difficult it is to mine. This increases the cost of production significantly and thus the price of the cryptocurrency.

Cryptocurrency exchanges

While most exchanges list the most popular cryptocurrencies like Ethereum and Bitcoin, many smaller tokens are only found on select, mostly decentralized, exchanges. This limits their access to investors. Some wallet provider swapping services for a fee allow investors to swap their assets across several exchanges. This fee increases the cost of investing further.

On the other hand, if a particular coin or token is listed on multiple exchanges, this might further increase the number of investors wanting to buy it, thus driving up demand and the price further.

Eterna’s Decentralized Exchange (DEX) allows investors to buy cryptocurrencies and futures contracts in a wide range of cryptocurrencies. Minimize your risks and maximize your profit potential by finding the right trades through Eterna’s new Copy Trading feature.

Competition

Although the entry barrier in the cryptocurrency space is low, thanks to new projects and tokens being launched every day, coming up with a viable token or coin that investors will want to hold become increasingly difficult.

A good crypto backed by solid technology that adds value to the market can help increase its popularity thereby driving up its value while a competitor’s token may fall in value.

Internal governance

Although most cryptocurrency projects do not usually follow any set of rules, developers try to adapt the projects around the needs of the community that uses them. Some tokens like governance tokens let the holders have a say in how the project is administered, including how it’s mined, used, and burned. However, changes can only take place when there’s consensus among the stakeholders.

Decisions such as moving Ethereum’s Proof of Work ecosystem into a Proof of Stake render the expensive equipment used by miners useless. It also drives down production and electricity costs which will in turn have an impact on the price of Ethereum.

Regulatory framework

Cryptocurrency still does not fall under the purview of either the SEC (that deems cryptocurrency as stocks) or the CFTC (that views it like a commodity). This means that cryptocurrency exchanges do not come under the regulatory authority of either yet. This lack of regulation makes the crypto ecosystem less predictable due to the lack of clarity, and more volatile. (I don’t believe this is entirely correct). Perhaps you could say that legislation has yet to clarify the SEC and CFTC’s regulatory authority over crypto. The SEC refers various crypto scams to prosecution by the Justice Department. That sounds like authority to me. Also, what about Europe?

For example, regulation could help investors trade in cryptocurrency in easier ways such as ETFs and futures contracts thus increasing their value. It would also allow investors to open short positions in the market and use futures contracts to reduce the impact of volatility that crypto pricing is known for. Futures contracts are already available in crypto.

“Eterna’s DEX allows investors to enter into perpetual futures contracts helping them maximize their profit potential through leverage while allowing investors to reduce their downside risk.”

Conclusion

If you were to invest in cryptocurrency today or bet on the price of one for investment purposes, it would do you good to go beyond the principles of supply and demand and investigate the rest of the points mentioned in this article.

The more well-informed you are about the factors listed here, the better you will be able to predict price changes and open short or long positions successfully.

Due to the lack of regulations in this space, it remains an extraordinarily volatile market. However, informed decisions and the right kind of investment vehicles such as perpetual futures contracts can help hedge against adverse market conditions.

Ready to start investing and trading in the crypto market? Sign up on Eterna Exchange today and explore the tons of features the exchange packs in to make trading and investing a cakewalk for beginners and a fulfilling for seasoned traders.