Crypto exchanges offer different order types to traders and investors based on their experience and risk appetite.

In this article, we are going to explore 5 common crypto order types that are most used on exchanges, both crypto and stock.

What are the 5 common crypto order types?

- Market order

- Limit order

- Stop order

- Limit-Stop order

- Trailing stop order

Let’s dive right into it.

Note: the numbers and prices used in this article are only for example purposes and do not reflect current market prices.

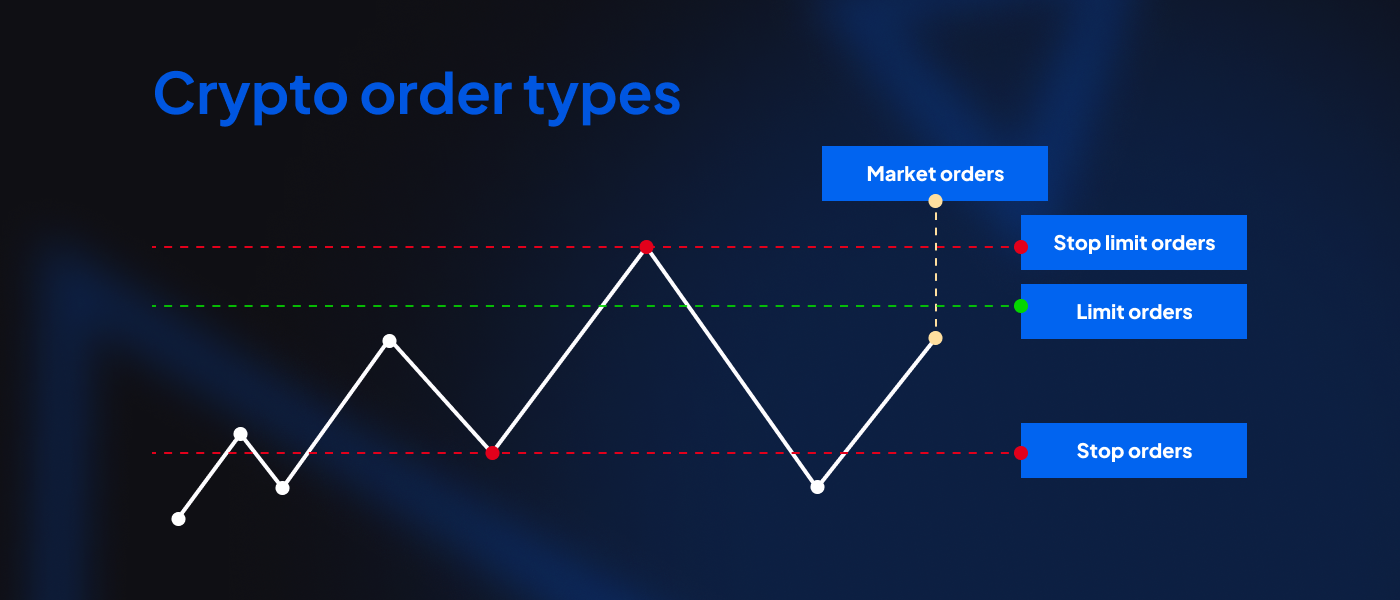

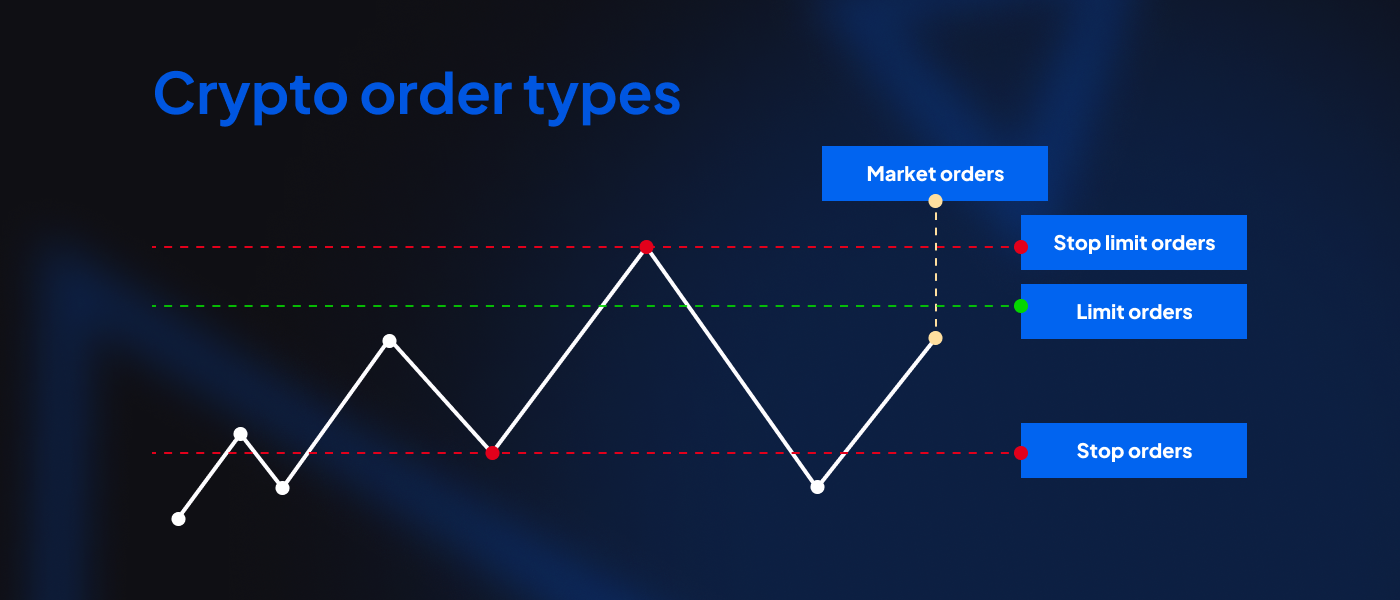

Market order

Market orders are the simplest and most standard ways of crypto trading. They are simple commands to buy or sell crypto at the most recent price on the exchange.

For example, if you would like to place a buy order for $BTC on the exchange when the current price is $30,000 per $BTC, you will get your share based on the same price.

The market order book is a constantly updated list of buyers and sellers, and the buy/sell order is executed based on the most recent price updated on the exchange. As a buyer or seller, all you need to do is enter how much crypto you would like to buy/sell and the exchange will then match you to an open order from the order book and the deal will go through.

Every market order is subject to a fee called the “taker fee” levied by the exchange.

Further, the price of cryptocurrency varies across exchanges, apart from the cryptos that are popular and are available across exchanges like $BTC, $ETH, and $XRP.

Crypto fact: There’s a type of trader, called arbitrageurs, who profit from minor price differences across exchanges.

Limit order

Limit orders let you buy or sell crypto at a preferred price. It helps keep a record of your preference on the exchange and execute the order as soon as the exchange reflects the preferred price for the crypto you’d like to buy/sell.

This helps traders execute orders without monitoring the market movements 24*7. All they need to do is mention how much crypto they want to buy and at what price.

For example, you believe that $BTC will fall to $30,000 per Bitcoin and would like to buy one whole Bitcoin at that price. You will then set a limit order mentioning the limit to $30,000. The deal will go through as soon as $BTC reaches $30,000.

Alternatively, the order might not go through at all as $BTC might never reach $30,000. This is the risk with Limit orders. However, maker fees on limit trades are lesser than taker fees (market order trades) which makes these trades less expensive when they do go through.

Stop orders

Stop orders are useful when you are expecting the market prices to go up or down and would like to sell or buy when that happens.

Say, for example, you would like to sell 10 BTC if the market price for $BTC falls from $30,000 to $29,000.

Similarly, if you expect the prices to go up from $30,000 per BTC to $32,000, you know that even if you buy each BTC at $31,000, you still stand to make a profit of $1000 per BTC when the market reaches the $32,000 mark.

Stop-sell orders, on the other hand, are used to limit losses in a highly volatile market. For example, if you see the price of BTC falling steadily, and you want to limit your losses, you can put in a stop-loss order specifying a price of $29,000 per BTC. If the price falls below that then your order will not go through and you will still have your coins in your wallet. This way you mitigate your losses in a volatile market and don’t sell in panic leading to losses.

The risk with stop orders is that they are only visible when the market reaches the specified amount and they fulfill the order at a higher or lower amount based on the backlogs in the order book. This is where Stop-Limit orders come into the picture.

Stop-Limit order

The stop-limit order helps protect you from market volatility or flash crashes. It gives you an option of adding a limit to your stop order so that it does not fulfill above or below a certain price. For example, if you are willing to sell each $BTC at $29,000 in a plummeting market but do not want to go below $27,000 then the order gets activated when it hits $29,000 but it does not go through till it hits $27,000. If the price does fall below $27,000 and your order is still not met due to backlog, it will not go through and you’ll still have the coins in your wallet.

The same holds if you want to place a buy order. With this, you can limit your losses, and have more control over your wallet and funds, even in volatile market conditions.

Trailing stop order

If you want to further limit your losses in case your predictions about the market do not pan out the way you had expected to, then you have the trailing stop order option.

In this order type, you could benefit from a floating percentage or spread that will protect you from losses due to a volatile market. For example, if you are expecting a dip in an otherwise bullish market and expect $BTC to fall below $30,000, you can add a stop order at $29,000 specifying that your coins will be sold when the market hits $29,000 for one BTC. However, you see that the price continues to climb to $31,000 and on to $32,000. This will leave you with a loss as you could have sold your coins at $32,000 but since you have pegged it at $29,000 you cannot execute the order now.

This is where the trailing stop order comes in. This option, as the name implies, trails with the market price up to a certain spread, which in this case is $1000, (Stop order pegged at $29,000 for a current market price of $30,000). This means that even if $BTC climbs to $31,000 your order will go through and you can record a profit of $1000 if not $2000 for when the market reaches $32,000.

This is a safe and practical way of safeguarding your wallet against market volatility and making the most of it in the process.

Conclusion

Making profitable trades in the crypto market needs experience, observation, and practice. If you are a beginner in crypto trading, you could start with simple market orders to see how they work out and keep an eye on how the prices are moving for each cryptocurrency or the ones you are interested in. There are several factors that govern the rise and fall of prices in the crypto space. You can then slowly move to the other order types to ensure lesser market fees and more protection against losses due to volatility.

Eterna Exchange’s Copy Trading feature lets traders use the trading methods and practices of seasoned traders and make the most of their investments in the crypto market without much knowledge or prior experience. With this feature, crypto traders stand to learn and earn at the same time, making the most of their funds and time.