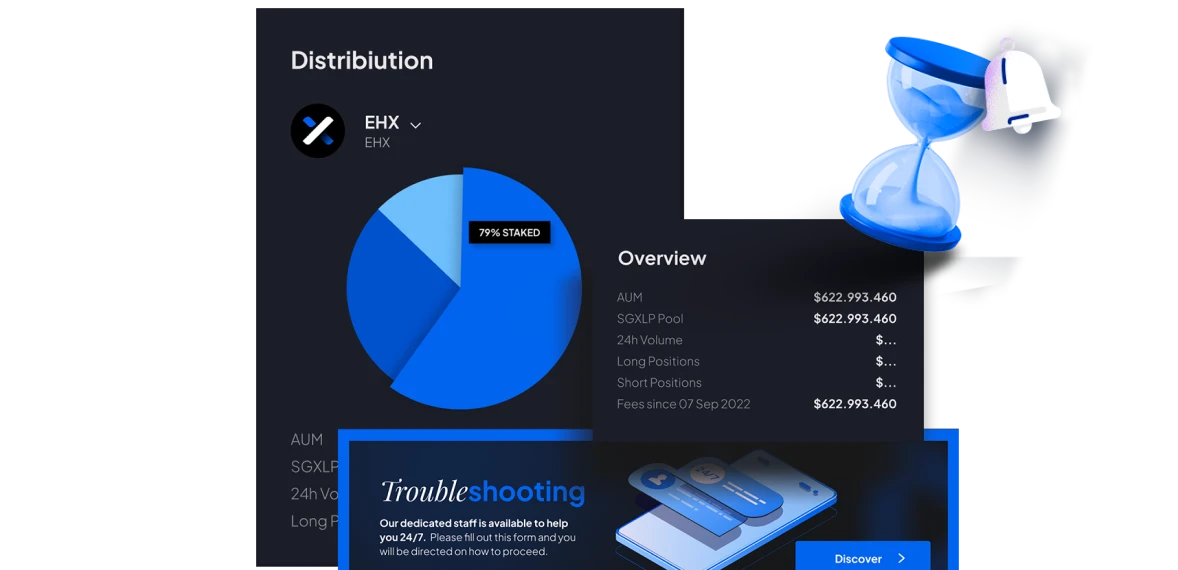

Eterna has launched its long-awaited Perpetual Futures DEX, as a first stage in its vision to re-invent crypto trading. Everyone knows that Eterna DEX will be unique, because 50% of its net income will be shared with EHX token stakers. That alone sets Eterna apart from its competition. While tantalizing, in order to fully comprehend all the benefits Eterna DEX has to offer, we must first answer the questions: What are Perpetual Futures and why has Eterna launched a DEX specifically focused on this market segment? In order to answer these questions, we must first gain a deeper understanding of the different sectors of the crypto market and how they operate.

Futures are part of the crypto derivatives market. A “derivative” is a financial instrument whose value is derived from the market price of an underlying asset. Derivatives are used to manage risk as well as to engage in speculation, because derivatives contracts allow two parties to to agree today about the terms of a transaction at a future date. More specifically, a futures contract permits two parties to agree at time t = 0 (now) about the transaction price of an asset or commodity at time t = 1 (in the future). Hence, a firm that wishes to manage future price risk can make an agreement today, to pay a pre-determined price in the future for a given commodity or asset, which eliminates uncertainty about the underlying asset’s future price at the date of transaction. Futures are a specific type of derivatives contract, that represent an agreement to buy or sell an asset at a pre-arranged price in the future, often using borrowed funds. Futures are also important because they can be traded on margin, which means that investors can borrow 2X – 125X their currently available funds, making futures potentially one of the most profitable investments in the market.

Eterna launched a DEX for Perpetual Futures, which differ from conventional futures contracts in that (1) perpetual futures are only traded in crypto markets, (2) perpetual futures do not expire, and (3) perpetual futures require financial settlements at regular intervals, rather than a transfer of ownership of the underlying asset. However, like other futures markets, investors on Eterna DEX can trade on margin, or leverage their investments 2X – 125X while limiting their downside risk, which means Eterna DEX one of the most exciting new exchanges in the crypto space.

What more do you need to know about the perpetual futures market?

According to TokenInsight, in 2021, the entire cryptocurrency market achieved a trading volume of $112 trillion, which is the highest trading volume achieved to date. Crypto derivatives in 2021 reached a trading volume of $57 trillion (or over 50% of total crypto trading volume), representing a 358% growth rate over 2021. According to The Block, in 2021, crypto spot market trading volume reached $14 trillion, but declined to $6.96 trillion in the first 10 months of 2022. By contrast, in 2021, perpetual futures trading volume reached $51 trillion, or approximately 45% of total crypto trading volume. In fact, Bitcoin Perpetual Futures alone reached $21.75 trillion in trading volume in 2021, but declined to $11.8 trillion in the first 10 months of 2022. Consequently, perpetual futures represent the largest and most profitable segment of crypto markets, and while smaller investors tend to focus on crypto spot market and yield farming, the bigger players trade heavily in crypto derivatives.

While perpetual futures constitute the largest segment of the crypto market, DEXs have only managed to capture 2% of this burgeoning sector, while 98% of perpetual futures are traded on CEXs. Rather than being a limitation, that means that DEXs and Eterna have enormous room to grow, because of the inherent security and anonymity of DEXs compared to their CEX counterparts. DEXs currently handle between 11-14% of spot trading volume, and if Perpetual Futures DEXs can replicate the growth rate of spot DEXs, then Eterna could establish significant market share by the next bull run. Currently, about 25 DEXs trade perpetual futures, which means that the market is still young, and there’s still room for competition and growth. Eterna intends to capitalize on this potential and gain market share and exposure months before the initiation of the next bull run, so that when the bull-run finally arrives, Eterna DEX will be in a position to lead the market and generate enormous profits for its token stakers.